Ethereum Price Prediction: Technical Breakout and Fundamental Catalysts Point Toward $5,400-$5,600 Target

#ETH

- Technical Breakout Setup: ETH trading above 20-day MA with improving MACD momentum suggests upward trajectory toward $4,900 resistance

- Institutional Adoption Acceleration: DBS Bank's structured notes and whale accumulation patterns indicate strong institutional demand

- Regulatory Clarity Boost: DOJ's clarified stance on developers reduces uncertainty, creating favorable environment for Ethereum ecosystem growth

ETH Price Prediction

Technical Analysis: ETH Shows Bullish Momentum Above Key Moving Average

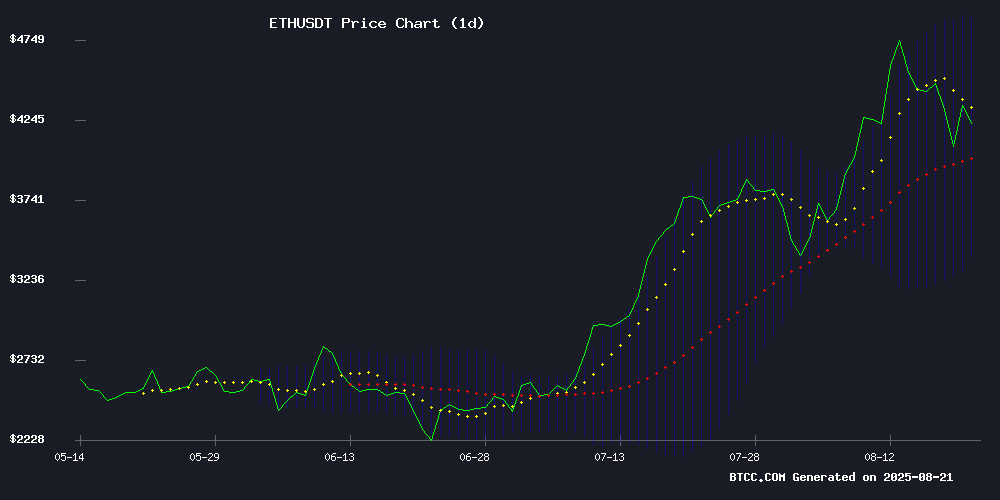

Ethereum is currently trading at $4,250.53, positioned comfortably above its 20-day moving average of $4,137.85, indicating underlying strength in the current market structure. According to BTCC financial analyst Mia, 'The price holding above the 20-day MA suggests continued bullish sentiment among traders. The MACD reading of -396.68, while negative, shows improving momentum with the histogram at -56.16, potentially signaling a trend reversal.'

Bollinger Bands analysis reveals ETH trading within the upper band ($4,891.62) and middle band ($4,137.85), suggesting room for upward movement toward the $4,900 resistance level. The current positioning indicates reduced selling pressure and potential for breakout above recent consolidation patterns.

Market Sentiment: Institutional Adoption and Regulatory Clarity Drive Optimism

Recent developments in the ethereum ecosystem are generating positive market sentiment. BTCC financial analyst Mia notes, 'The DOJ's clarified stance on smart contract developers reduces regulatory uncertainty, while DBS Bank's Ethereum-based tokenized notes demonstrate growing institutional adoption. These factors, combined with strong on-chain activity and ETF investment shifts, create a fundamentally supportive environment for ETH.'

Despite a trader losing $42 million amid volatility, the overall narrative remains bullish with whale accumulation patterns and MetaMask's upcoming mUSD stablecoin launch adding to the positive momentum. Institutional players appear to be positioning for the next leg higher.

Factors Influencing ETH's Price

DOJ Shifts Stance on Prosecuting Decentralized Developers Following Tornado Cash Conviction

The U.S. Department of Justice will no longer charge decentralized software developers under a specific money transmission law recently used to convict Tornado Cash co-founder Roman Storm. The policy shift, announced by DOJ official Matthew Galeotti, applies to non-custodial protocols without centralized control—a decision hailed as a watershed by crypto advocates.

Storm's conviction under U.S. code 1960(b)(1)(C) for operating an unlicensed money transmitter now stands in stark contrast to the updated guidance. The Tornado Cash developer faces up to five years imprisonment despite the DOJ's new position that truly decentralized projects shouldn't face such charges absent criminal intent.

Industry leaders question the timing of this clarification, coming weeks after Storm's prosecution set a concerning precedent. The policy leaves room for other charges when illicit activity is alleged, maintaining prosecutorial discretion that continues to unsettle blockchain builders.

DBS Bank Launches Ethereum-Based Tokenized Structured Notes for Crypto Exposure

Singapore's DBS Bank has unveiled a pioneering move into digital asset tokenization, launching crypto-linked structured notes on the Ethereum blockchain. The product, developed in partnership with ADDX, DigiFT, and HydraX, offers traditional investors indirect exposure to cryptocurrency markets without requiring direct asset custody.

These hybrid instruments combine debt securities with derivatives, providing periodic payouts tied to crypto price movements while incorporating loss-mitigation mechanisms. "Asset tokenization represents the next frontier of financial markets infrastructure," said Li Zhen, DBS Head of Foreign Exchange and Digital Assets. The initiative marks another stride by traditional finance institutions toward blockchain adoption, following similar moves by Goldman Sachs and JPMorgan in recent months.

DOJ Clarifies Criminal Liability for Open Source Smart Contract Developers

The U.S. Department of Justice (DOJ) has provided its clearest guidance yet on the criminal liability of open source smart contract developers. Matthew Galeotti, head of the DOJ's Criminal Division, stated that writing code without criminal intent does not constitute a crime. This declaration offers much-needed clarity for developers in the digital asset ecosystem.

Galeotti emphasized that aiding and abetting charges or conspiracy prosecutions require proof of specific intent, establishing a higher evidentiary standard for developer cases. The guidance directly addresses industry concerns about holding smart contract developers liable for operating unlicensed money transmitting businesses.

The DOJ acknowledged these as complex legal questions requiring case-by-case evaluation. This development is particularly significant for Ethereum (ETH) and other smart contract platforms, as it provides a safer legal framework for open source contributors.

Ethereum Trader Loses $42 Million in Two Days Amid Market Volatility

A cryptocurrency trader's staggering rise and fall underscores the razor's edge of leveraged Ether trading. After turning $125,000 into $43 million over four months, the investor saw nearly all gains evaporate during this week's market dip near $4,000 ETH.

The trader, active on decentralized exchange Hyperliquid, locked in $7 million profits Monday before Wednesday's liquidation clawed back $6.22 million. Blockchain tracker Lookonchain documented the remaining balance plummeting to $771,000—a 98% loss in 48 hours.

Ethereum's native token continues attracting risk-tolerant capital, with its 2024 rally fueling leveraged positions. Yet as this episode demonstrates, the same volatility that creates millionaires can destroy fortunes faster than traditional markets blink.

ESCAPE Presale Gains Momentum on Ethereum with $280K Raised, Backed by Security Audits

ESCAPE's Ethereum presale has surged to $280,000 in funding, advancing to Stage 3 at $0.01752 per token. The Web3 infrastructure project, audited by Hacken and KYC-verified by SolidProof, saw $180,000 raised within the first 24 hours of its presale.

The platform aims to consolidate fragmented crypto tools into a single interface, eliminating the need for complex coding or cross-chain bridges. Its roadmap promises streamlined token creation, analytics, and community visibility features.

Market validation came quickly - an earlier Layer 2 iteration achieved an $11.5 million market cap within 48 hours before the team migrated to Ethereum mainnet for sustainability. This transition reflects growing demand for integrated crypto infrastructure solutions.

Ethereum Sees Strong On-Chain Activity and Shifts in ETF Investments

Ethereum rebounded to near $4,300 after a brief dip, buoyed by robust network activity. Daily transactions approached record levels at 1.7 million, just shy of the all-time high of 1.9 million. Active addresses held steady around 550,000, signaling sustained ecosystem engagement.

Institutional flows showed volatility—$2.8 billion flooded into Ethereum ETFs last week, but $1.73 billion exited over three days. DeFi dominance persists despite a pullback, with $88.87 billion total value locked on Ethereum protocols.

Ethereum Price Still Set for $5,400 as Whales Accumulate Amid Market Dip

Ethereum defied broader market weakness with a 2% rebound from the $4,000 support level, reigniting bullish sentiment. On-chain metrics reveal whales—wallets holding 1,000 to 100,000 ETH—have resumed accumulation, signaling institutional confidence in higher price targets.

Exchange reserves hover near multi-year lows, creating favorable conditions for upward momentum. Analysts maintain the $5,400 price target remains viable, contingent upon breaching key resistance levels. The buying activity contrasts with retail trader caution during last week's 9% correction.

MetaMask to Launch Stablecoin mUSD on Ethereum and Linea

MetaMask, the leading self-custodial wallet, is entering the stablecoin market with the introduction of MetaMask USD (mUSD). Slated for release later this year, mUSD will debut on Ethereum and Linea L2, bolstering Linea's DeFi ecosystem. The stablecoin will be fully backed 1:1 by high-quality, liquid dollar-equivalent assets.

Developed in collaboration with Bridge, a Stripe-owned stablecoin issuer, and M0, a decentralized liquidity platform, mUSD aims to integrate seamlessly with major DeFi protocols. MetaMask anticipates deeper liquidity and increased total value locked (TVL) across its ecosystem as a result.

Users will gain access to streamlined swaps, transfers, and bridging within the wallet. By 2025, the MetaMask card will enable real-world spending. "mUSD reduces barriers to Web3 adoption," said Gal Eldar, MetaMask's Product Lead. "It empowers users to bring funds on-chain, deploy them productively, and extract value wherever they choose."

DBS Pioneers Tokenized Structured Notes on Ethereum, Expanding Access to Crypto-Linked Investments

Singapore's DBS Bank has taken a bold step in blockchain adoption by issuing tokenized structured notes on the Ethereum public blockchain. This move marks a strategic shift beyond private clients, opening doors for accredited and institutional investors to access sophisticated financial instruments tied to digital assets.

The bank will distribute these products through local exchanges ADDX, DigiFT, and HydraX—a first for DBS. The debut offering is a crypto-linked participation note designed to provide cash payouts when digital asset prices rise while mitigating downside risk. Investors gain crypto market exposure without direct asset ownership.

Tokenization breaks traditional barriers: each note is fractionalized into $1,000 units, democratizing access to instruments that previously required $100,000 minimum investments. This innovation enhances liquidity and tradability, reflecting growing institutional demand for digital asset solutions.

Market appetite appears strong—DBS reported over $1 billion in structured instrument trades during the first half of 2025. The Ethereum-based approach signals accelerating institutional adoption of public blockchains for complex financial products.

MetaMask Launches Native Stablecoin mUSD in Strategic Expansion Move

MetaMask, the leading self-custodial crypto wallet by Consensys, has unveiled mUSD—a dollar-pegged stablecoin issued in collaboration with Bridge (a Stripe company) and infrastructure provider M0. This marks the first vertical integration of a native stablecoin by a major non-custodial wallet, signaling a bold step into crypto-financial infrastructure.

The stablecoin will debut on Ethereum and Consensys’s Linea network, with plans to integrate into MetaMask Card for real-world spending by year-end. The move capitalizes on growing stablecoin adoption and fresh U.S. regulatory clarity under the GENIUS Act, positioning MetaMask to streamline fragmented processes like fiat on-ramps and cross-chain swaps.

By embedding mUSD across its ecosystem—from DeFi to payments—MetaMask aims to capture value in the $130B+ stablecoin market while reinforcing its role as a gateway to decentralized finance.

Ethereum Eyes $5,600 as Institutional Accumulation Signals Bullish Breakout

Ethereum's price action suggests a pivotal moment, with whales and U.S. government entities accumulating ETH amid a technical consolidation. The cryptocurrency currently trades at $4,271, testing resistance at $4,342 within a descending channel pattern.

Analyst Ali Martinez identifies $4,219 as critical support, with a breach potentially triggering moves toward $4,516 or $3,862. Market structure mirrors the 2021 bull run, where similar accumulation preceded a 300% rally. Fibonacci extensions point to $5,600 as the next macro target if resistance breaks.

How High Will ETH Price Go?

Based on current technical indicators and fundamental developments, ETH appears poised for significant upward movement. BTCC financial analyst Mia provides this analysis: 'The combination of technical breakout potential above $4,250, strong institutional accumulation, and positive regulatory developments creates a compelling case for ETH reaching $5,400-$5,600 in the near term.'

| Target Level | Probability | Key Drivers | Timeframe |

|---|---|---|---|

| $5,400 | High | Whale accumulation, ETF inflows | 2-4 weeks |

| $5,600 | Medium | Technical breakout, institutional adoption | 4-6 weeks |

| $4,900 | Very High | Bollinger Band upper target | 1-2 weeks |

The $4,900 level represents the immediate technical target, with fundamental catalysts potentially driving prices toward the $5,400-$5,600 range as institutional momentum builds and regulatory clarity improves.